Not known Facts About Hsmb Advisory Llc

9 Simple Techniques For Hsmb Advisory Llc

Table of ContentsThe smart Trick of Hsmb Advisory Llc That Nobody is DiscussingThe Best Strategy To Use For Hsmb Advisory LlcOur Hsmb Advisory Llc IdeasHow Hsmb Advisory Llc can Save You Time, Stress, and Money.All About Hsmb Advisory LlcAll about Hsmb Advisory LlcThe Ultimate Guide To Hsmb Advisory Llc

Be aware that some plans can be costly, and having certain health problems when you apply can raise the premiums you're asked to pay. You will certainly need to see to it that you can pay for the costs as you will certainly need to dedicate to making these payments if you want your life cover to continue to be in positionIf you really feel life insurance coverage could be beneficial for you, our partnership with LifeSearch permits you to get a quote from a variety of suppliers in dual quick time. There are various sorts of life insurance policy that intend to fulfill various protection requirements, consisting of degree term, decreasing term and joint life cover.

The Greatest Guide To Hsmb Advisory Llc

Life insurance coverage supplies 5 monetary advantages for you and your household (Insurance Advisors). The major advantage of adding life insurance policy to your monetary plan is that if you die, your successors get a lump amount, tax-free payment from the policy. They can utilize this cash to pay your final expenses and to change your earnings

Some policies pay if you establish a chronic/terminal disease and some offer savings you can make use of to support your retirement. In this article, find out regarding the various advantages of life insurance policy and why it may be a good concept to buy it. Life insurance policy offers advantages while you're still to life and when you die.

Not known Incorrect Statements About Hsmb Advisory Llc

If you have a plan (or policies) of that dimension, individuals that depend on your revenue will still have cash to cover their ongoing living costs. Beneficiaries can utilize policy benefits to cover crucial day-to-day expenses like rental fee or mortgage repayments, energy bills, and grocery stores. Average annual expenses for households in 2022 were $72,967, according to the Bureau of Labor Stats.

Things about Hsmb Advisory Llc

Furthermore, the money value of entire life insurance policy grows tax-deferred. As the cash worth constructs up over time, you can use it to cover expenses, such as acquiring an auto or making a down settlement on a home.

If you determine to borrow against your cash money worth, the lending is exempt to revenue tax obligation as long as the plan is not given up. The insurer, however, will certainly bill interest on the funding quantity till you pay it back (https://pastebin.com/u/hsmbadvisory). Insurance click to find out more coverage business have varying rates of interest on these finances

9 Simple Techniques For Hsmb Advisory Llc

8 out of 10 Millennials overstated the cost of life insurance in a 2022 study. In actuality, the ordinary expense is better to $200 a year. If you assume purchasing life insurance might be a smart economic action for you and your family members, consider talking to a financial consultant to adopt it into your monetary plan.

The 5 main types of life insurance are term life, entire life, global life, variable life, and final expenditure insurance coverage, additionally understood as funeral insurance. Entire life starts out setting you back more, however can last your entire life if you maintain paying the costs.

Get This Report about Hsmb Advisory Llc

It can repay your debts and clinical expenses. Life insurance policy might additionally cover your mortgage and give money for your household to maintain paying their costs. If you have household relying on your income, you likely need life insurance policy to support them after you die. Stay-at-home moms and dads and local business owner also commonly require life insurance coverage.

Essentially, there are 2 kinds of life insurance policy intends - either term or irreversible strategies or some combination of the 2. Life insurance providers supply different forms of term strategies and typical life plans in addition to "passion delicate" items which have become more common considering that the 1980's.

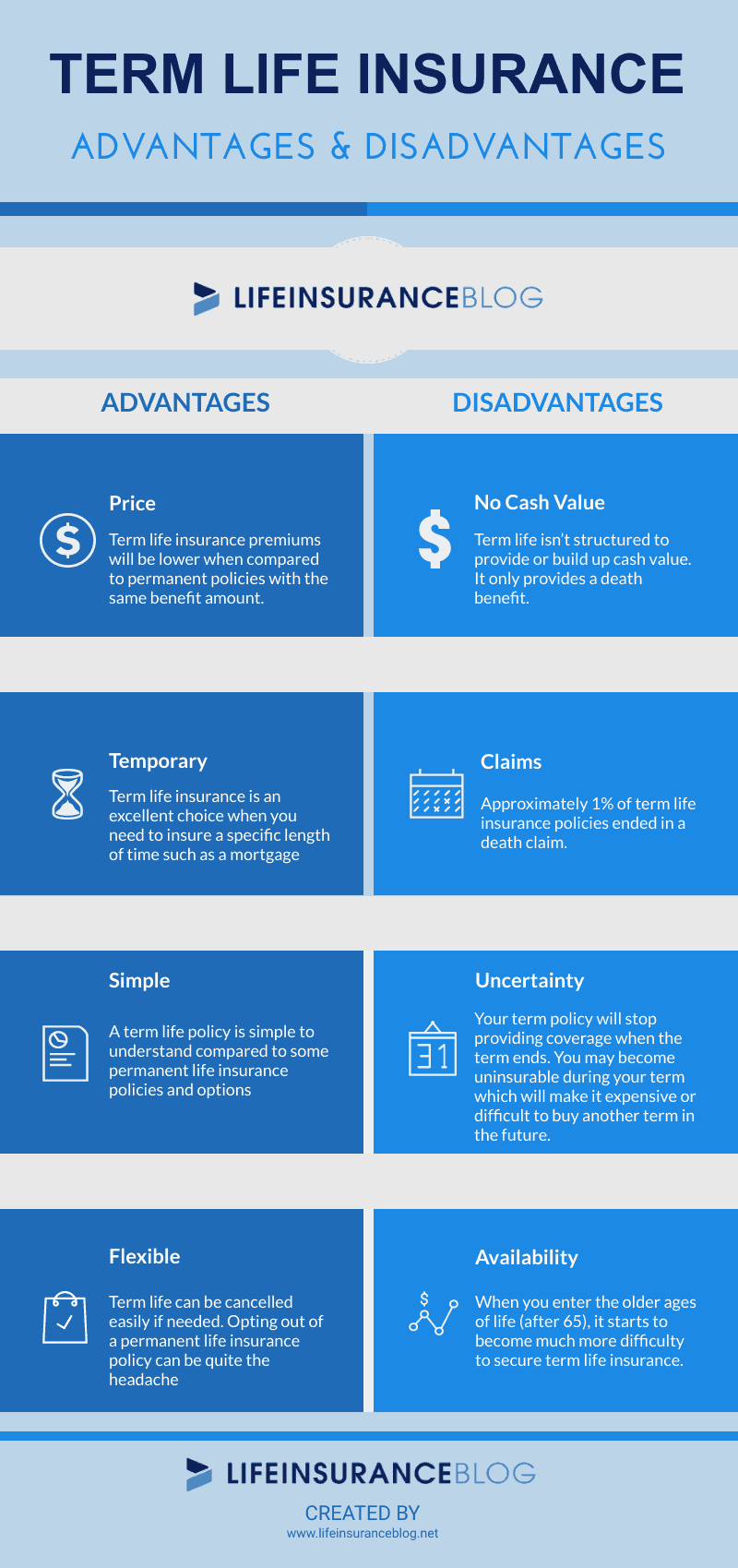

Term insurance coverage provides protection for a specific amount of time. This period might be as short as one year or supply protection for a specific number of years such as 5, 10, 20 years or to a defined age such as 80 or sometimes up to the oldest age in the life insurance policy death tables.

The Facts About Hsmb Advisory Llc Uncovered

Presently term insurance coverage prices are very affordable and among the most affordable historically knowledgeable. It should be noted that it is an extensively held belief that term insurance policy is the least expensive pure life insurance policy coverage offered. One requires to assess the plan terms meticulously to determine which term life options appropriate to fulfill your certain situations.

With each new term the costs is increased. The right to renew the plan without proof of insurability is an important advantage to you. Or else, the threat you take is that your wellness may weaken and you might be not able to acquire a policy at the same rates or perhaps whatsoever, leaving you and your beneficiaries without protection.